Crypto whitelists function as specialized digital databases that regulate access to blockchain activities, including token sales and NFT distributions. These systems verify participant eligibility through identity verification processes, ensuring compliance with AML and KYC regulations while preventing unauthorized access and potential fraud. By implementing whitelists, cryptocurrency platforms improve security, maintain regulatory standards, and foster community engagement through controlled participation methods. Understanding these mechanisms reveals the deeper complexities of blockchain security infrastructure.

Gatekeeping in the digital domain takes on new importance through crypto whitelists, specialized databases that regulate access to blockchain activities and cryptocurrency transactions. These carefully curated lists serve as digital filters, determining which wallet addresses or participants can engage in specific blockchain activities, thereby enhancing security and maintaining regulatory compliance in the cryptocurrency ecosystem.

In the context of token sales and NFT distributions, whitelists function as vital tools for controlling access and ensuring fair participation. Projects implementing Initial Coin Offerings (ICOs) or Initial Exchange Offerings (IEOs) utilize these lists to verify eligible participants, reducing the risk of fraudulent activities while maintaining compliance with Anti-Money Laundering (AML) and Know Your Customer (KYC) regulations, and typically require personal identity verification. Statistical evidence suggests that over 80% of ICO-related scams could have been prevented through proper whitelist implementation. The integration of approved participants ensures legitimate access to token sales while preventing unauthorized involvement.

Whitelists serve as digital gatekeepers, screening participants in token sales while enforcing regulatory compliance and preventing fraudulent activities.

The application of whitelists extends beyond traditional token sales into the burgeoning NFT marketplace, where they facilitate controlled minting processes and exclusive access to digital artworks. NFT projects utilize whitelists to reward active community members with priority access to minting opportunities, creating a structured approach to distribution while minimizing the risk of bot activity and market manipulation. Similar to how governance tokens enable voting rights in DAOs, whitelists empower selected community members with exclusive privileges.

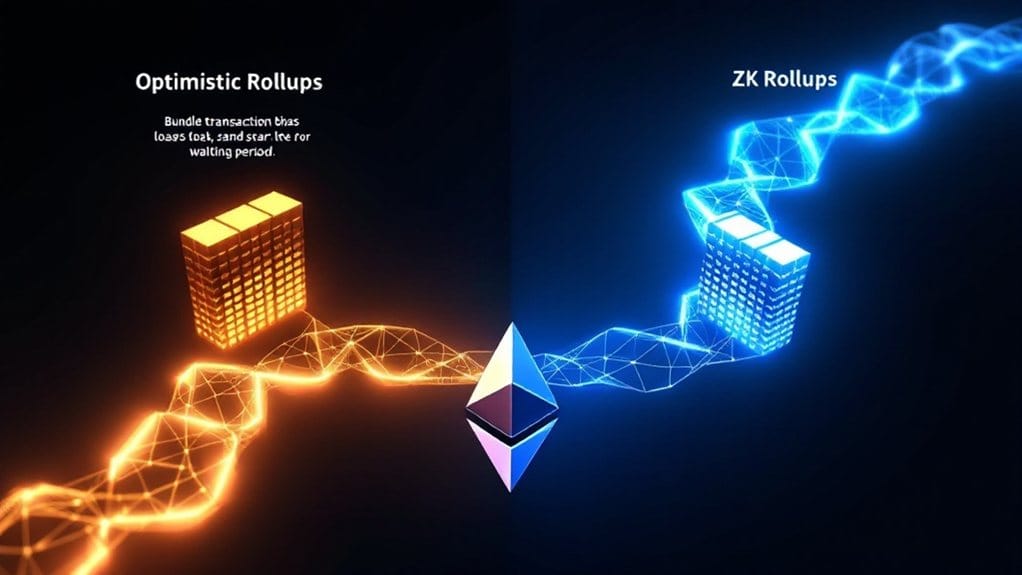

Whitelists play a pivotal role in securing cryptocurrency transactions within centralized exchanges and decentralized finance (DeFi) platforms. By limiting withdrawal addresses to pre-approved destinations, these systems greatly reduce the risk of unauthorized transfers and potential security breaches.

Moreover, whitelists serve as powerful marketing tools, generating anticipation and exclusivity through controlled access to blockchain-based offerings. The implementation of whitelists demonstrates the cryptocurrency industry's evolution toward more secure and regulated operations.

Through careful verification processes and controlled access mechanisms, these systems protect participants while fostering community engagement and trust. As the blockchain ecosystem continues to mature, whitelists remain fundamental components in maintaining security, ensuring compliance, and facilitating orderly distribution of digital assets across diverse platforms and projects.

FAQs

How Do I Get Added to a Cryptocurrency Whitelist?

To join a cryptocurrency whitelist, individuals must typically complete several key steps: register through the project's official platform, undergo KYC verification by submitting identification documents, provide a valid cryptocurrency wallet address, and actively engage with the project's community.

Many projects prioritize early registrants and those demonstrating consistent participation through social media channels, while some may require staking tokens or meeting specific criteria for eligibility.

Can I Sell My Whitelist Spot to Another Investor?

Selling whitelist spots is generally prohibited and strongly discouraged within crypto projects for several key reasons.

Most projects require KYC verification, making spot transfers technically impossible since they're tied to specific identities.

Moreover, transferring spots violates typical project terms of service, risks disqualification, and may constitute regulatory violations.

Projects actively monitor and ban users attempting to trade or sell their whitelist positions.

What Happens if I Miss the Whitelist Registration Deadline?

Missing a whitelist registration deadline typically results in several key consequences:

- Loss of early access privileges and potentially favorable token/NFT pricing

- Increased competition when attempting to participate in public sales

- Limited options for project participation, often restricted to alternative markets

- Higher entry costs due to market demand and reduced availability

- Potential requirement to wait for future rounds or alternative participation methods

Projects rarely make exceptions for missed deadlines due to fairness and security protocols.

Are Whitelisted Addresses Transferable Between Different Cryptocurrency Projects?

Whitelisted addresses are generally not transferable between different cryptocurrency projects due to project-specific implementation and security protocols.

Each project maintains its own distinct whitelist parameters, verification processes, and smart contract requirements.

While a user may be whitelisted for multiple projects simultaneously, the whitelist status itself remains unique to each individual project, ensuring proper security measures and regulatory compliance are maintained.

Do I Need KYC Verification for Every Whitelist I Join?

KYC verification requirements vary considerably between different whitelists, as each project determines its own verification standards.

While regulatory-sensitive projects, particularly those involving token sales or ICOs, typically mandate KYC compliance, other initiatives like NFT minting events or community-driven whitelists may employ alternative verification methods.

Projects might use blockchain-based verification, social proof, or community engagement metrics instead of traditional KYC processes.