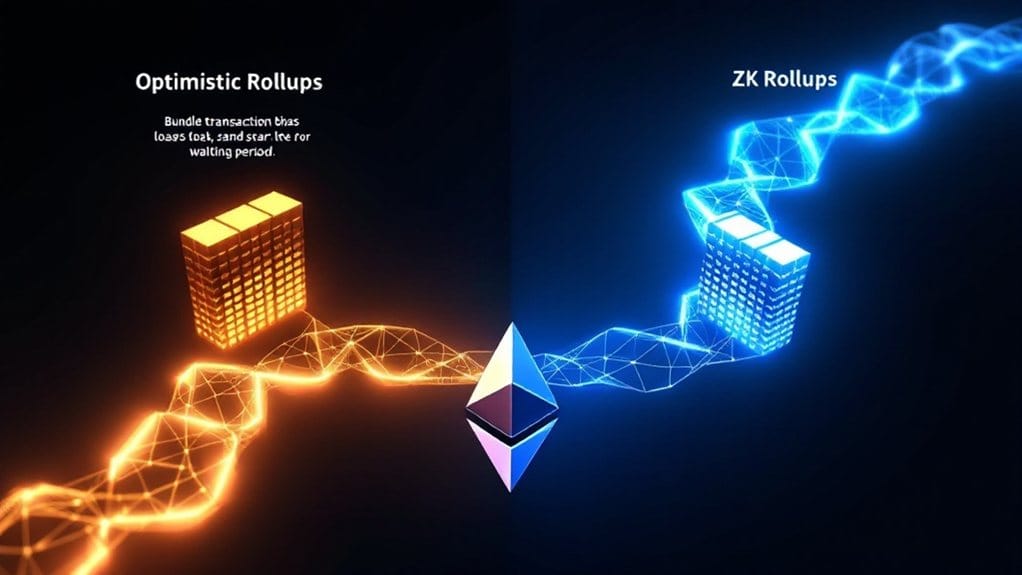

Optimistic Rollups and ZK-Rollups represent two primary Layer 2 scaling solutions for Ethereum, each offering distinct advantages. Optimistic Rollups dominate with 85% market adoption, assuming transactions are valid unless challenged, while requiring longer withdrawal periods. ZK-Rollups utilize zero-knowledge proofs, providing immediate finality and improved privacy but demanding higher computational resources. The choice between them depends on specific needs: Optimistic Rollups excel in efficiency and smart contract compatibility, while ZK-Rollups prioritize security and privacy, marking the beginning of a complex technological comparison.

As blockchain technology continues to evolve, two prominent Layer 2 scaling solutions have emerged to address Ethereum's scalability challenges: Optimistic Rollups and ZK-Rollups. Both solutions aim to increase transaction throughput and reduce costs by processing transactions off-chain, but they employ fundamentally different approaches to achieve these goals. These solutions work by bundling transactions together to minimize the data load on the main blockchain. Leading protocols like Optimism and Arbitrum represent the main competitors in the optimistic rollup space.

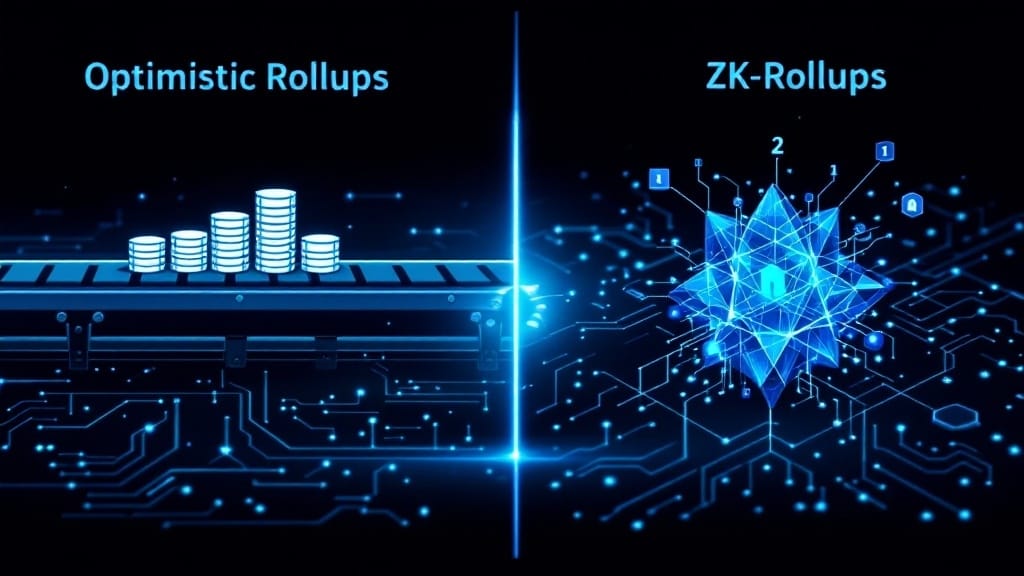

Optimistic Rollups, which currently dominate the market with an 85% adoption rate, operate under the assumption that all transactions are valid unless proven otherwise. This solution implements a challenge period during which transactions can be disputed, making it highly efficient and cost-effective for users, though it results in longer withdrawal times. The system's compatibility with existing Ethereum tools has made it particularly attractive for DeFi applications, while its ability to execute complex smart contracts provides additional utility for developers. By maintaining state channels, these solutions enable fast and secure off-chain transactions while preserving the security guarantees of the mainnet.

ZK-Rollups, in contrast, utilize zero-knowledge proofs to verify transactions without revealing transaction details, offering improved privacy and immediate transaction finality. This sophisticated approach eliminates the need for challenge periods and reduces the amount of data transmitted to the main chain, though it comes with higher computational requirements and associated costs. The technology has proven especially valuable for privacy-centric applications, gaming platforms, and NFT marketplaces where security and confidentiality are paramount.

The scalability benefits of both solutions are substantial, with Optimistic Rollups potentially offering 10-100x improvements in transaction processing capacity. While ZK-Rollups may send less data to Layer 1 due to their validity proofs, they currently face limitations in smart contract support compared to their optimistic counterparts.

The choice between these solutions often depends on specific use case requirements, with Optimistic Rollups favoring efficiency and user experience, and ZK-Rollups prioritizing security and privacy features. As the technology continues to mature, both solutions demonstrate promising potential for addressing Ethereum's scaling challenges, though each carries its own set of tradeoffs regarding implementation complexity, cost structure, and security considerations.

FAQs

Can Rollups Completely Replace Layer 1 Blockchains in the Future?

Rollups cannot completely replace Layer 1 blockchains because they fundamentally depend on L1 for security, consensus, and data availability.

While rollups improve scalability and transaction processing, they function as complementary solutions rather than replacements, relying on Layer 1's decentralized infrastructure.

The technical architecture of rollups necessitates a secure base layer for posting transaction data and resolving disputes, making Layer 1 blockchains indispensable for the foreseeable future.

How Do Rollups Affect Transaction Privacy Compared to Regular Blockchain Transactions?

Transaction privacy varies considerably between different rollup implementations.

ZK-Rollups improve privacy through zero-knowledge proofs, concealing transaction details while maintaining verifiability.

In contrast, Optimistic Rollups require public transaction data, offering similar privacy levels to Layer 1 blockchains.

This distinction makes ZK-Rollups more suitable for privacy-sensitive applications, while Optimistic Rollups prioritize transparency and easier validation of transactions.

What Happens to Rollup Funds if the Operator Suddenly Disappears?

In the event of operator disappearance, both rollup types have built-in safeguards.

ZK-rollups allow immediate fund retrieval through Layer 1 verification, while Optimistic rollups implement escape hatches that enable forced withdrawals after a dispute period.

Users can challenge incorrect state changes through fraud proofs in Optimistic systems, and ZK-rollups' cryptographic proofs guarantee transaction validity regardless of operator status.

Which Rollup Type Requires Less Computational Power From Validators?

Optimistic Rollups require considerably less computational power from validators since they operate under an assumption of transaction validity, only needing extensive computation during fraud challenges.

Validators primarily monitor for suspicious activity rather than validating each transaction, making their computational demands minimal.

In contrast, ZK-Rollups demand constant computational resources to generate zero-knowledge proofs for every transaction batch, requiring specialized hardware and more intensive processing power.

Do Rollups Make Blockchain Networks More Vulnerable to Security Attacks?

Rollups introduce additional security layers but also new potential vulnerabilities. While they inherit base layer security from L1 blockchains, they face unique challenges including centralization risks, smart contract vulnerabilities, and upgrade-related issues.

However, proper implementation of defense mechanisms like Multi-Provers, escape hatches, and formal specifications can effectively mitigate these risks, making rollups a relatively secure scaling solution when properly designed and maintained.