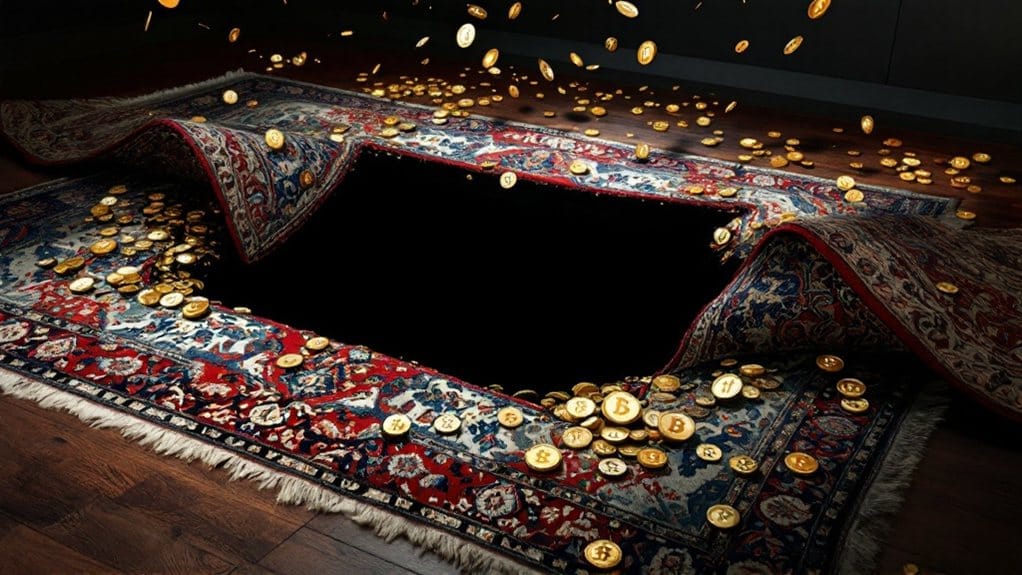

Rug pull scams occur when cryptocurrency project developers abandon their projects and steal investor funds through manipulated smart contracts, resulting in over $2.8 billion in losses annually. Key warning signs include anonymous development teams, unrealistic return promises, lack of liquidity locks, and aggressive marketing without technological substance. Investors can protect themselves by conducting thorough due diligence, verifying team identities, reviewing audited smart contracts, and evaluating genuine community engagement. Understanding these fundamental security measures opens the door to safer cryptocurrency investments.

While cryptocurrency markets continue to evolve at a rapid pace, rug pull scams have emerged as one of the most devastating forms of fraud within the decentralized finance ecosystem. These malicious schemes involve project developers abandoning their cryptocurrency projects and absconding with investor funds, leaving holders with worthless tokens and significant financial losses, which exceeded $2.8 billion in a single year.

Rug pulls manifest in several forms, with hard rug pulls representing immediate fund drainage and soft rug pulls involving gradual token selloffs by developers. Many projects employ flashy marketing campaigns to lure unsuspecting investors before disappearing with collected funds. The manipulation often occurs through smart contracts without proper legal oversight, while the inherent anonymity and lack of regulation in decentralized finance create an environment conducive to fraudulent activities. Notable cases like Thodex Exchange demonstrate the massive scale of these scams, with its CEO disappearing with approximately $2 billion in investor funds.

Deceptive developers exploit smart contract vulnerabilities and DeFi anonymity to orchestrate both rapid and gradual theft of investor funds.

Investors can identify potential rug pulls by watching for specific warning signs, including anonymous development teams, unrealistic promises of exceptional returns, and absence of liquidity locks. Projects featuring aggressive marketing campaigns without substantial technological development or genuine community engagement should raise immediate concerns, as should unusual tokenomics structures that concentrate power in the hands of a few holders. Scammers often exploit social proof by fabricating testimonials and community engagement to create an illusion of legitimacy.

To protect against rug pulls, investors must conduct thorough due diligence on project teams, smart contract code, and token distribution mechanisms. Verification of team identities, review of audited smart contracts, and assessment of community engagement levels serve as vital steps in risk mitigation.

Furthermore, investors should remain vigilant against excessive marketing tactics and emotional manipulation through FOMO (fear of missing out).

Regulatory bodies have begun addressing the prevalence of rug pull scams through increased oversight and investor protection frameworks. However, the decentralized nature of cryptocurrency markets and jurisdictional complexities often impede effective enforcement actions.

As the cryptocurrency ecosystem matures, the implementation of stronger regulatory measures, combined with improved investor education and improved due diligence protocols, will be fundamental in reducing the frequency and impact of rug pull scams.

FAQs

Can Law Enforcement Recover Funds Lost in Crypto Rug Pull Scams?

Law enforcement can recover stolen crypto funds, though success rates vary considerably.

While blockchain transparency aids investigation, rapid fund movement through mixers and cross-chain swaps complicates recovery efforts. Authorities collaborate with exchanges to freeze assets and employ specialized forensic tools, but jurisdictional challenges and cryptocurrency's decentralized nature often impede full recovery.

Prompt reporting of incidents substantially increases the likelihood of fund retrieval.

What Are the Legal Consequences for Creators Who Execute Rug Pulls?

Creators executing rug pulls face severe legal repercussions, including wire fraud charges carrying up to 20 years imprisonment, money laundering penalties, and securities fraud prosecution.

The Department of Justice actively pursues these cases, while the SEC investigates them as securities violations.

International authorities may impose additional sanctions, including asset freezes and trading bans.

Class-action lawsuits from victims can result in substantial civil penalties and restitution orders.

How Long Do Rug Pull Scams Typically Take to Execute?

Rug pull scams typically execute within 24-72 hours once initiated, though the preparation phase can last weeks or months.

The fastest variants, known as "flash rug pulls," can occur within minutes through automated smart contracts, while more sophisticated operations may extend over several days to avoid detection.

The execution speed primarily depends on three factors: market liquidity, investor participation levels, and the complexity of the exit mechanism.

Are Hardware Wallets Effective in Protecting Against Rug Pull Scams?

Hardware wallets provide robust security against unauthorized access and hacking attempts but offer limited protection against rug pull scams specifically.

While these devices safeguard private keys and require physical confirmation for transactions, they cannot prevent investors from voluntarily participating in fraudulent projects.

The core vulnerability in rug pulls lies in the project's trustworthiness and contract design, not in wallet security mechanisms.

Which Blockchain Networks Have the Highest Incidents of Rug Pull Scams?

Ethereum and Binance Smart Chain (BSC) consistently record the highest incidents of rug pull scams, primarily due to their widespread adoption in DeFi projects.

Ethereum's prevalence of ERC-20 tokens and BSC's lower transaction costs make them particularly vulnerable targets.

While Solana and Polygon also experience rug pulls, their occurrence rates remain considerably lower, with unaudited smart contracts across these networks being the most susceptible to malicious activities.