Calculating a cryptocurrency’s true value involves analyzing multiple fundamental metrics, including market capitalization, realized value, and network activity indicators. The process examines market cap relative to transaction volume through the NVT ratio, while incorporating Metcalfe’s Law to evaluate network effects based on user growth. Technical fundamentals like hash rate, consensus mechanisms, and tokenomics provide additional valuation parameters, while broader market analysis compares potential against traditional assets. These interconnected factors reveal deeper insights into cryptocurrency valuation mechanisms.

While cryptocurrency valuation remains a complex endeavor, understanding how to calculate the value of digital assets requires a methodical analysis of multiple interconnected factors. The fundamental starting point involves calculating market capitalization by multiplying the circulating supply by the current price, which provides a baseline measurement of the cryptocurrency’s total market value. Understanding that market sentiment affects pricing more than actual investment inflow helps provide better context for valuations. Large-cap cryptocurrencies tend to demonstrate more stability in their valuations compared to smaller ones.

Calculating cryptocurrency value demands rigorous analysis of multiple factors, beginning with market cap as the essential baseline metric.

A more nuanced calculation incorporates realized capitalization, which values coins based on their last transfer price rather than current market price, effectively reducing the impact of lost or dormant coins. The Market Value to Realized Value (MVRV) ratio further refines this analysis by comparing market capitalization to realized capitalization, helping investors identify potential market overvaluation or undervaluation periods.

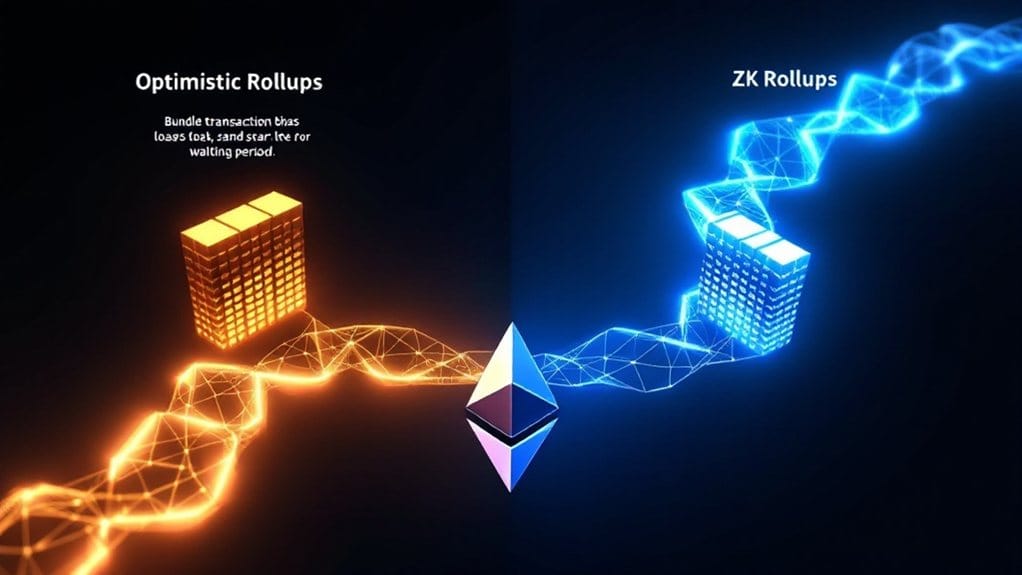

Network activity metrics play an essential role in determining cryptocurrency value, particularly through the analysis of daily active addresses and transaction volumes. The Network Value to Transactions (NVT) ratio measures market capitalization relative to transaction volume, while Metcalfe’s Law suggests that network value grows proportionally to the square of user numbers, providing a framework for valuation based on network effects. Bitcoin’s network value demonstrated this principle when its market cap increased fivefold as its user base doubled to 52 million.

Technical fundamentals, including hash rate and consensus mechanisms, contribute considerably to value calculation by indicating network security and efficiency. For proof-of-work cryptocurrencies, the production cost model establishes a baseline value by considering mining expenses, while proof-of-stake systems require analysis of total value locked and staking metrics.

The Total Addressable Market (TAM) model offers perspective by comparing cryptocurrency market potential to established markets like gold or global monetary systems. Moreover, tokenomics analysis examines supply mechanisms, distribution models, and utility factors that influence long-term value proposition.

When combined with on-chain data analysis and liquidity metrics, these diverse approaches create a thorough framework for calculating cryptocurrency value, though market sentiment and macroeconomic factors continue to influence short-term price movements considerably.

FAQs

Can Cryptocurrency Value Be Manipulated by Large Institutional Investors?

Large institutional investors can considerably manipulate cryptocurrency values through multiple mechanisms, including futures trading, large-volume transactions, and coordinated market actions.

Their substantial financial resources and advanced trading technologies enable price influence through strategic buying and selling patterns, while their ability to execute massive trades can create artificial supply-demand dynamics.

Moreover, institutions can exploit informational advantages and market inefficiencies, potentially driving considerable price movements across cryptocurrency markets.

How Do Government Regulations Affect Cryptocurrency Valuations Across Different Markets?

Government regulations substantially influence cryptocurrency valuations through multiple mechanisms across different markets.

When nations implement strict regulatory frameworks, such as South Korea’s mandatory KYC requirements, local trading volumes and prices often decline initially.

Conversely, supportive regulations in jurisdictions like Switzerland can enhance valuations by increasing institutional confidence and market participation.

Cross-border regulatory differences create arbitrage opportunities, leading to price variations across geographic regions.

What Role Do Social Media Influencers Play in Cryptocurrency Price Movements?

Social media influencers substantially impact cryptocurrency price movements through their market-moving posts and endorsements, often triggering short-term volatility.

Through strategic content creation and large follower bases, these individuals can influence trading behavior, leading to rapid price fluctuations. Their activities frequently result in temporary market sentiment shifts, particularly affecting smaller cryptocurrencies with lower trading volumes.

However, these price movements tend to be unsustainable without fundamental backing and often revert once influencer attention diminishes.

How Does Mining Difficulty Impact the Long-Term Value of Cryptocurrencies?

Mining difficulty directly influences cryptocurrency value through multiple technical mechanisms.

Higher difficulty levels increase network security and reduce new coin creation rates, potentially supporting long-term value by constraining supply.

Moreover, difficulty adjustments affect miner profitability, operational costs, and network hash rates, which collectively impact market dynamics.

When mining becomes more challenging, it typically signals growing network strength and adoption, though excessive difficulty can strain smaller miners and affect decentralization.

Why Do Similar Cryptocurrencies Often Have Significantly Different Market Values?

Similar cryptocurrencies often exhibit different market values due to variations in their underlying technological capabilities, market adoption rates, and community engagement levels.

Network effects play a vital role, as cryptocurrencies with larger user bases typically command higher valuations through increased utility and trust.

Moreover, factors such as development team reputation, marketing effectiveness, and strategic partnerships greatly influence market perception and subsequent valuation disparities between seemingly comparable digital assets.