GPU cryptocurrency mining remains profitable in 2024, with select coins yielding monthly profits between $66-100 per GPU for efficient setups. ASIC-resistant cryptocurrencies like Ravencoin, Ethereum Classic, and Zcash offer viable opportunities, though profitability depends heavily on electricity costs and market conditions. Success requires strategic cryptocurrency selection, access to affordable power, and efficient hardware configurations. Understanding the intricate relationships between these factors reveals promising pathways to mining profitability.

Graphics Processing Units (GPUs) have emerged as a cornerstone technology in cryptocurrency mining, offering miners a versatile solution for generating digital assets through complex computational processes. Initially popularized for Bitcoin mining in October 2010, GPUs utilized their parallel processing capabilities to perform the intensive calculations required for blockchain validation, though they have since been largely displaced by ASICs in Bitcoin mining specifically.

Despite shifting market dynamics, GPU mining remains viable for select cryptocurrencies designed with ASIC-resistant algorithms. Coins like Ravencoin, utilizing the KAWPOW algorithm, generate approximately $87 monthly profit per GPU, while Ethereum Classic and Zcash offer $66.74 and $100 monthly returns respectively. These profits, however, fluctuate greatly based on market conditions, electricity costs, and network difficulty adjustments. Monthly profits can decline by 30-40% in regions with elevated electricity rates. Hashprice calculations determine the expected earnings for each unit of computing power invested.

ASIC-resistant cryptocurrencies offer viable mining returns, with Ravencoin, Ethereum Classic, and Zcash yielding monthly profits between $66 and $100 per GPU.

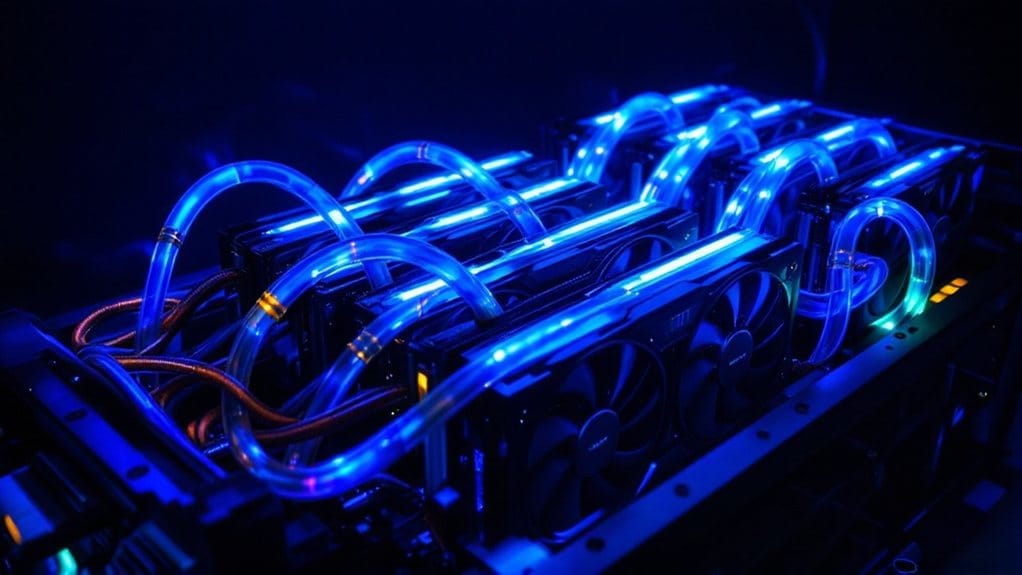

The financial viability of GPU mining operations depends heavily on several interconnected factors, including access to affordable electricity, hardware efficiency, and cryptocurrency market prices. Modern mining operations often employ multiple GPUs to enhance hashing power, though this approach requires substantial initial investment and ongoing maintenance costs. RandomX algorithm makes Monero particularly attractive for miners seeking profitability with standard computer hardware.

Successful miners frequently diversify their operations across multiple cryptocurrencies to maintain profitability amid market volatility.

Current technological trends indicate that while GPU mining profitability has decreased due to rising competition and energy costs, opportunities persist in mining ASIC-resistant altcoins. The adaptability of GPUs allows miners to switch between different cryptocurrencies as market conditions change, providing a strategic benefit over specialized ASIC hardware.

However, environmental concerns regarding energy consumption, coupled with high operational costs, present considerable challenges to long-term sustainability.

The future of GPU mining likely depends on continued development of ASIC-resistant algorithms and the emergence of energy-efficient mining solutions. While the days of explosive profits may have passed, strategic approaches to GPU mining, including careful consideration of electricity costs, hardware selection, and cryptocurrency choice, can still yield positive returns for well-planned operations.

FAQs

What Happens to Mining GPUS After They Are No Longer Profitable?

Mining GPUs can be repurposed for different profitable applications after their mining utility diminishes.

Many are sold in tertiary markets for gaming and professional graphics work, while others find new life in AI processing and data center operations.

Moreover, these GPUs often serve educational institutions for computational research, or they’re integrated into render farms for 3D animation studios, maintaining value through alternative use cases.

Can Mining Cryptocurrency Damage My Gpu’s Long-Term Performance?

Cryptocurrency mining can indeed impact GPU longevity through continuous thermal stress and component wear.

Extended periods of high-intensity operation can degrade memory modules and voltage regulators, potentially reducing performance over time.

However, proper cooling solutions, controlled power management, and maintaining temperatures below 80°C can greatly minimize these risks.

Regular maintenance, including dust removal and thermal paste replacement, helps preserve GPU functionality for sustained mining operations.

Should I Join a Mining Pool or Mine Independently?

Mining pools offer significant advantages for newcomers and small-scale operators, providing steady returns through shared resources and distributed risks.

While independent mining allows complete operational control, the substantial computing power required for consistent block validation makes it impractical for most individual miners.

Statistical data indicates that pool mining typically yields 20-30% higher returns compared to solo mining, primarily due to regular reward distributions and optimized resource allocation.

How Often Should I Update My Mining Software?

Mining software should be updated monthly at minimum to maintain peak performance and security.

Critical security patches and emergency updates should be implemented immediately upon release.

Users should enable automatic updates when available, while major software versions typically require quarterly updates.

Regular updates guarantee compatibility with new algorithms, protect against vulnerabilities, and maintain efficient hash rates for maximum mining profitability.

What’s the Minimum Internet Speed Required for Cryptocurrency Mining?

Cryptocurrency mining requires minimal internet bandwidth, with 5 Mbps being sufficient for most mining operations, including small to medium-sized farms.

While speed is less significant, connection stability and latency play vital roles, with ideal performance achieved at around 70ms latency.

A stable, wired Ethernet connection is recommended over WiFi, consuming only 100-200 megabytes of data monthly while maintaining consistent mining efficiency.