NFTs are transforming gaming by establishing verifiable digital ownership of in-game assets through blockchain technology, enabling players to truly own and trade virtual items across platforms. The gaming NFT market reached $4.8 billion in transactions in 2021, with projections showing growth to $820.78 billion by 2028. Through NFT integration, developers are creating new revenue models while players gain unprecedented control over their digital assets, marking a fundamental shift in gaming economics. This emerging ecosystem presents opportunities to investigate groundbreaking changes in virtual ownership and value creation.

As blockchain technology continues to reshape the virtual environment, Non-Fungible Tokens (NFTs) have emerged as a groundbreaking force in the gaming industry, fundamentally altering how players interact with and own digital assets. These unique digital tokens, stored securely on blockchain networks, provide verifiable proof of ownership and authenticity for in-game items, characters, and virtual real estate, marking a significant departure from traditional gaming models where players merely license digital content. Players now have true ownership over their digital assets through their private keys.

The gaming NFT market demonstrated remarkable growth in 2021, with transactions reaching $4.8 billion, driven by pioneering projects like CryptoKitties and Axie Infinity. These platforms introduced innovative play-to-earn models, enabling players to generate real economic value through gameplay, trading, and asset ownership. Major brands like digital fashion houses are entering the gaming space, offering unique wearables and accessories for player avatars. Players can now monetize their gaming achievements by selling rare items, participating in virtual economies, and transferring assets across different gaming platforms through blockchain interoperability.

Game developers have adopted NFTs as a means to create new revenue streams and improve player engagement through digital scarcity and exclusive content. Popular titles like Illuvium and Alien Worlds demonstrate how blockchain integration can create immersive gaming experiences while maintaining player ownership of valuable digital assets. The market is projected to experience substantial growth, with estimates suggesting the NFT gaming industry will reach $820.78 billion by 2028.

The decentralized nature of NFTs guarantees that players retain control of their assets independently of game platforms, fostering a more equitable gaming ecosystem.

However, the integration of NFTs in gaming faces notable challenges, including environmental concerns related to blockchain energy consumption, security risks in digital transactions, and market volatility affecting asset values. Copyright and intellectual property issues also present complex legal considerations for developers and content creators, while some gaming communities have expressed skepticism about the technology's implementation.

Despite these challenges, the continued evolution of NFT gaming models, supported by advancing blockchain technology and increasing market adoption, suggests a fundamental shift in how digital ownership and value creation operate within the gaming industry, pointing toward a future where players have unprecedented control over their virtual assets.

FAQs

How Can Game Developers Prevent Nft-Related Scams in Their Gaming Marketplaces?

Game developers can implement multi-layered security protocols, including smart contract auditing and identity verification systems, while maintaining robust marketplace monitoring tools.

Through blockchain-based authentication mechanisms and automated fraud detection algorithms, developers can identify suspicious trading patterns and potential scams.

Furthermore, establishing clear reporting channels, implementing mandatory KYC procedures, and deploying real-time transaction monitoring helps safeguard users against NFT-related fraud within gaming ecosystems.

What Happens to Gaming NFTS if the Game Server Shuts Down?

When game servers shut down, gaming NFTs retain their existence on the blockchain but lose significant functionality and value.

While players maintain technical ownership of these digital assets, the inability to use them within the intended game environment severely diminishes their utility.

Although NFTs can still be traded on external marketplaces, their worth often plummets due to the loss of their primary purpose and functionality within the gaming ecosystem.

Can NFTS Be Transferred Between Different Gaming Platforms and Ecosystems?

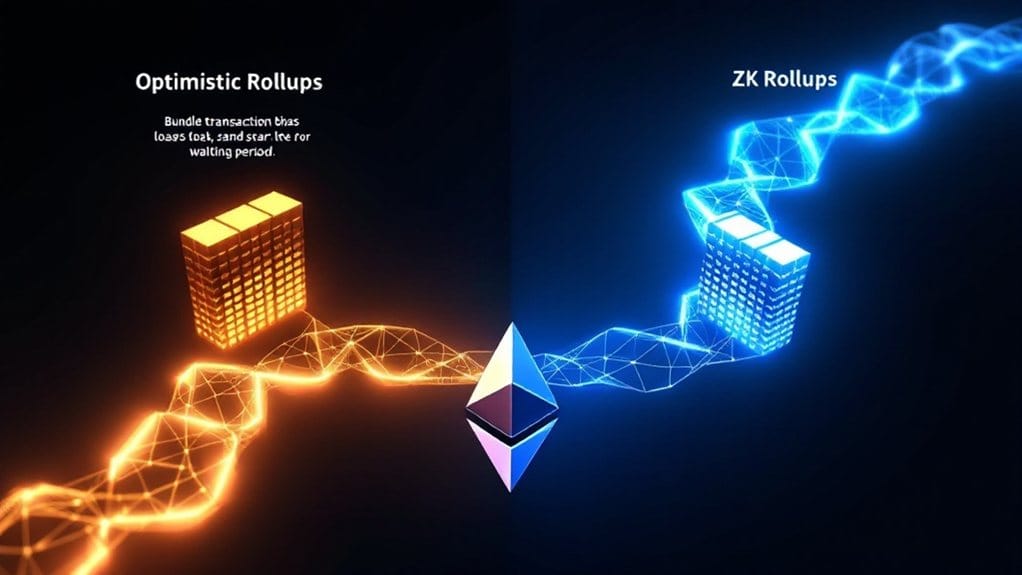

NFTs can be transferred between gaming platforms through blockchain networks and token bridges, though significant technical barriers exist.

While ERC-721 and ERC-1155 standards enable basic interoperability, platform-specific implementations often limit cross-platform functionality.

Currently, most successful transfers occur within the same blockchain ecosystem, typically Ethereum-based networks.

Complete cross-platform compatibility requires advanced infrastructure and standardized protocols, which are still in development.

How Do Gaming NFTS Affect the Environmental Sustainability of Video Games?

Gaming NFTs contribute to environmental impact through blockchain energy consumption, particularly when utilizing proof-of-work protocols.

While traditional video games primarily consume energy through device usage and server operations, NFT integration adds another layer of environmental concern.

However, the industry's shift toward proof-of-stake systems, like Ethereum's recent change, has reduced NFT-related emissions by approximately 99.95%, making gaming NFTs more environmentally sustainable than their early counterparts.

What Regulations Exist for Trading Gaming NFTS Across International Borders?

Trading gaming NFTs across borders involves multiple regulatory frameworks, with key requirements varying by jurisdiction.

The EU's MiCA regulation may classify certain gaming NFTs as security tokens, while platforms must comply with German BaFin licensing for local users.

Trading platforms generally must implement AML protocols and KYC checks for high-value transactions, particularly in jurisdictions like the UK and UAE's ADGM, where specific licenses and compliance measures are mandatory.