Setting up a cryptocurrency wallet involves selecting between software (hot) wallets for daily transactions and hardware (cold) wallets for secure long-term storage. Users must initially evaluate their needs, considering factors like transaction frequency, security requirements, and supported cryptocurrencies. The setup process typically includes downloading wallet software, generating recovery phrases, and implementing security measures such as two-factor authentication and strong passwords. Understanding these fundamental steps opens the gateway to secure digital asset management.

As cryptocurrencies continue to reshape the financial landscape, setting up a secure crypto wallet has become a vital initial step for anyone looking to participate in digital asset transactions. Crypto wallets come in several forms, each serving distinct purposes and security needs, with the primary types being software wallets (hot wallets), hardware wallets (cold storage), custodial wallets, paper wallets, and hosted wallets provided by exchanges.

The selection process for a suitable wallet requires careful consideration of several key factors, including intended usage patterns, security requirements, and supported cryptocurrencies. Software wallets, while offering convenience through mobile or desktop applications, require proper security measures such as strong passwords and two-factor authentication. Most exchanges accept ACH or wire transfers for funding crypto purchases.

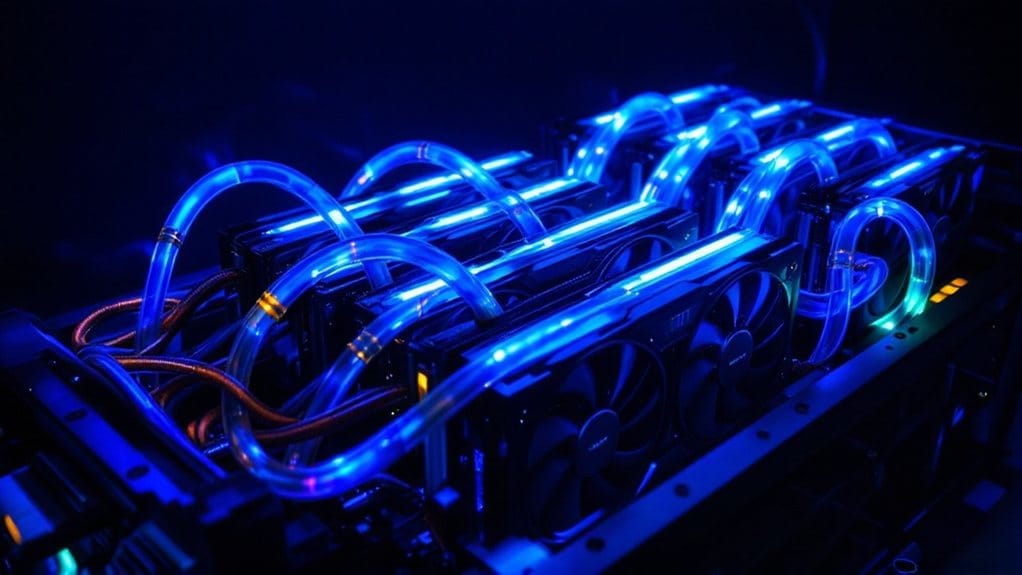

Hardware wallets, conversely, provide improved security by storing private keys offline on physical devices, making them ideal for long-term storage of significant cryptocurrency holdings. These devices are particularly secure as they operate mostly offline, connecting to the internet only when necessary for transactions.

The setup process varies depending on the chosen wallet type, with software wallets typically requiring users to download an application, create an account, and generate a recovery phrase consisting of 12 or 24 words. Hardware wallets involve purchasing a physical device from manufacturers like Ledger or Trezor, installing companion software, and establishing security protocols such as PIN codes before transferring assets. Using a password manager can help securely store and manage the complex passwords required for wallet access.

Security remains paramount in crypto wallet management, with emphasis placed on protecting private keys and recovery phrases. Users must implement strong encryption methods, regularly update their wallet software, and maintain secure backups of recovery phrases in offline locations.

The implementation of two-factor authentication adds an additional layer of security, while regular transaction monitoring helps detect unauthorized access attempts.

For ideal wallet management, users should consider dividing their holdings between hot wallets for regular transactions and cold storage for long-term savings. Regular software updates, transaction monitoring, and adherence to security best practices guarantee the safe storage and transfer of digital assets.

The choice between different wallet types ultimately depends on individual needs, with factors such as frequency of use, security requirements, and technical expertise playing significant roles in the decision-making process.

FAQs

What Happens if I Forget My Crypto Wallet Password?

The consequences of forgetting a crypto wallet password depend on the wallet type.

With custodial wallets, typically hosted by exchanges, password recovery is possible through customer support.

However, for non-custodial wallets, losing the password without having the seed phrase results in permanent loss of access to funds.

Recovery services using brute force methods exist but are expensive and not guaranteed to succeed.

Can I Store Different Types of Cryptocurrency in One Wallet?

Modern cryptocurrency wallets typically support multiple digital assets within a single interface.

Software wallets like Exodus and Trust Wallet can store hundreds of distinct cryptocurrencies simultaneously, while hardware wallets such as Ledger offer similar multi-currency capabilities.

Even blockchain-specific wallets, like MetaMask for Ethereum-based tokens, can manage numerous assets within their respective ecosystems, making portfolio management more streamlined and accessible for users.

How Much Does It Cost to Maintain a Crypto Wallet?

The cost of maintaining a crypto wallet typically ranges from $5,000 to $50,000 annually, depending on complexity and features.

Primary expenses include regular security audits, blockchain protocol updates, and development team salaries.

Additional costs stem from customer support infrastructure, external service integrations, and regulatory compliance measures.

For individual users of existing wallets, maintenance costs are generally minimal, primarily involving network transaction fees.

Are Hardware Wallets Better Than Software Wallets for Security?

Hardware wallets offer superior security compared to software wallets due to their offline storage of private keys, making them virtually immune to online threats.

Their built-in secure elements and TPMs protect against physical tampering, while internal transaction verification reduces manipulation risks.

Although software wallets provide convenience through immediate access, their constant internet connectivity exposes them to potential cyberattacks, malware, and unauthorized access attempts.

What Should I Do if My Crypto Wallet Gets Hacked?

Immediate response to a crypto wallet hack requires disconnecting the compromised device from the internet and changing all associated passwords.

Users should notify relevant authorities, including the wallet provider, while reviewing transaction history for unauthorized transfers.

Subsequently, implementing two-factor authentication, securing linked accounts, and transferring remaining assets to a new, secure wallet using flashbots will help minimize losses and prevent further unauthorized access.