The NFT marketplace employs specialized terminology crucial for collectors to master, from fundamental concepts like floor prices and gas fees to advanced trading strategies such as sniping and flipping. Key terms include non-fungibility, which distinguishes unique digital assets, minting processes that record ownership on the blockchain, and utility tokens that offer real-world benefits. Understanding technical aspects like tokenomics, oracles, and cross-chain bridges enables collectors to navigate the evolving digital asset landscape with confidence, while mastering community-specific terms reveals deeper market insights.

The rapidly evolving landscape of Non-Fungible Tokens (NFTs) has given rise to a distinctive vocabulary that collectors must master to navigate the digital asset marketplace effectively. Understanding these terms is vital for both newcomers and experienced traders who engage in the buying, selling, and creation of unique digital assets on diverse blockchain platforms.

Mastering NFT terminology has become essential for digital asset traders navigating the complex blockchain marketplace with confidence and expertise.

At the foundation of NFT terminology lies the concept of non-fungibility, which distinguishes these tokens from interchangeable cryptocurrencies through unique identification codes and metadata stored on the blockchain. Smart contracts govern these digital assets, automating ownership transfers while maintaining an immutable record of transactions, provenance, and authenticity, particularly significant for digital art pieces commonly stored in JPEG format. Many projects feature generative art using trait combinations to create thousands of unique pieces.

Market-specific terminology includes fundamental concepts such as floor price, which indicates the lowest available price for an NFT within a specific collection, and gas fees, which represent the computational costs associated with blockchain transactions. Traders employ various strategies, from sniping undervalued assets to flipping for quick profits, while more patient collectors might choose to HODL or demonstrate diamond hands during market volatility. Many collectors leverage curated NFT marketplaces to ensure they purchase verified, high-quality digital assets. Digital artists can create unique NFT trading cards using design platforms like Adobe Photoshop or Canva before minting them on popular marketplaces.

The metaverse has introduced additional complexity to NFT terminology, incorporating utility tokens that offer real-world benefits and soulbound tokens that remain permanently linked to specific users. Play-to-earn games have emerged as a notable application, rewarding participants with valuable NFTs while fostering community engagement through shared experiences and achievements.

Community interaction within NFT spaces has developed its own linguistic patterns, with terms like “alpha” referring to valuable insider information and “rug pull” warning of potential scams.

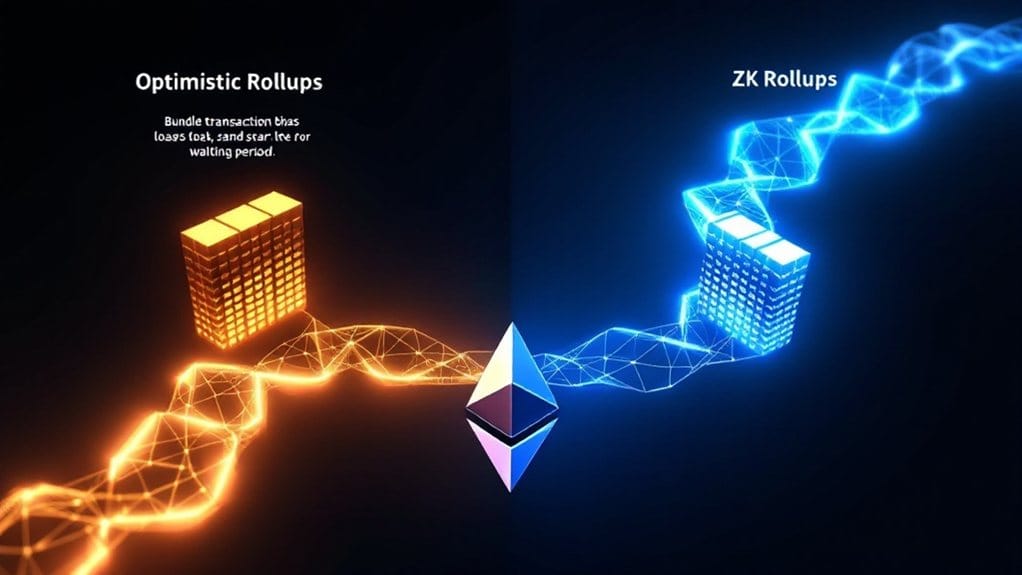

The technical aspects of NFT creation and distribution encompass processes such as minting, which records new tokens on the blockchain, and airdrops, which distribute tokens to targeted wallet addresses. Advanced concepts include tokenomics for analyzing economic metrics, oracles for external data integration, and bridges for cross-chain transfers, all contributing to the sophisticated ecosystem of digital asset trading and collection.

FAQs

How Can I Spot NFT Scams and Protect Myself From Fraudulent Sales?

To identify NFT scams, investors should verify seller credentials through blockchain history, cross-reference artwork authenticity across platforms, and use established marketplaces like OpenSea or Rarible.

Protection strategies include utilizing secure wallets with two-factor authentication, safeguarding private keys and seed phrases, implementing burner wallets for untrusted transactions, and avoiding suspicious links.

Price analysis across platforms helps detect pump-and-dump schemes and artificial inflation.

What Determines the Future Value Potential of an NFT Collection?

Several key factors determine an NFT collection’s future value potential.

Creator reputation and artistic innovation greatly impact market perception, while scarcity through limited editions drives collector demand.

Cultural relevance and social engagement contribute to long-term sustainability, and utility features, such as metaverse integration or exclusive access rights, improve practical value.

The collection’s historical significance and market timing also play essential roles in value appreciation.

Which NFT Marketplaces Charge the Lowest Gas Fees for Transactions?

Several marketplaces offer particularly low gas fees through different blockchain implementations.

OpenSea and Openc utilize Polygon’s network to enable gasless transactions, while Magic Eden employs Solana’s efficient blockchain for minimal fees.

The WAX blockchain provides consistently low fees through its managed network, and AstroZero eliminates gas fees entirely through meta transactions.

Binance NFT maintains competitive costs with a simple 1% transaction fee structure.

Can I Create and Sell NFTS Without Coding Knowledge?

Creating and selling NFTs is possible without coding knowledge through different no-code platforms and tools.

Platforms like Rampp and Crossmint Console handle smart contract deployment automatically, while generative tools such as Nifty Generator enable artwork creation.

Users can mint NFTs directly on marketplaces like OpenSea, and services like Typedream facilitate website building for NFT projects.

Marketing and community engagement remain essential for success, regardless of technical expertise.

What Are the Tax Implications of Buying and Selling NFTS?

NFTs are classified as property for tax purposes, with profits subject to capital gains taxation.

Short-term gains face ordinary income tax rates, while long-term holdings qualify for reduced rates of up to 20%, unless classified as collectibles (28%).

Creators must report income and royalties, potentially incurring self-employment tax, while trading NFTs for other NFTs constitutes a taxable event requiring documentation.